This year has seen more millennials migrating to Madison than any other metropolitan area. To show for it, the downtown area now has three poké restaurants, two spin studios and a shop dedicated solely to açaí bowls. But what does the influx of millennials mean for your rent?

Preston Schmitt, 27, has been living in Madison for nearly 10 years. He first moved here to attend college since he started school at UW-Madison in 2010 and continues to reside in various neighborhoods since graduating in 2014. He said finding an affordable place to live has not gotten easier post-graduation.

“If you want to live alone as a millennial or young professional, you’re gonna have to set aside a significant amount of your paycheck,” Schmitt said. “It’s very hectic in Madison, [with] these West-Side, tech-sector companies growing, the university growing and families and young professionals all competing for the minimal amount of homes going on the market.”

Affordable housing in Madison

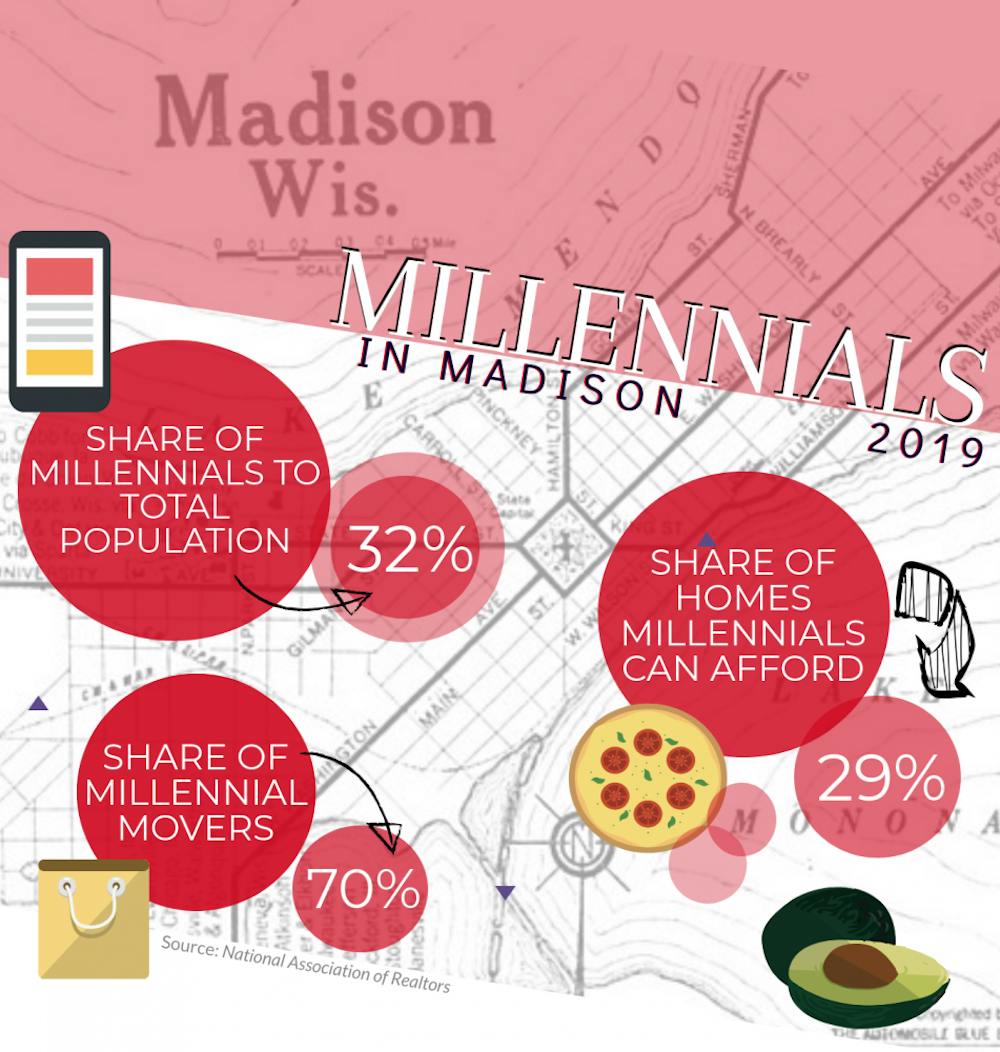

If you’re wondering whether you’re a millennial or not, you’re not alone. The classification for this generation is constantly redefined and not consistent. The National Association of Realtors, however, identifies millennials as anyone falling between the ages of 21 to 39.

Various factors contribute to why millennials migrate to certain areas — and why they choose to stay. One of the biggest considerations, according to a 2019 report by the NAR, is affordability.

Affordable housing has been the issue to tackle for several years now in Madison. Just last November, when the race for mayor was underway, affordable housing was identified as a chief concern for the candidates. Now Mayor Satya Rhodes-Conway stated that rent in Madison is “tight [and] verging on highly unaffordable."

This trend is displayed in the city’s rental vacancy rate — the percentage of all available units in a rental property that are unoccupied — which has bounced between 1 and 4 percent in the last decade.

The rate rests at a shallow 3.68 percent, according to the latest Madison Gas and Electric information — below the national target of 5 percent — meaning people struggling with lower incomes continue to compete for limited units that often are accompanied by high rents.

Still, the NAR’s report, released in April, stated that almost one-third of homes for sale are affordable to millennials who recently arrived. While 29 percent seems low, Nadia Evangelou, senior economist and director of forecasting with the NAR, reassures that Madison is ahead of the curve.

Madison had the lowest unemployment rate, at 2.2 percent, out of the 100 largest metro areas examined by the NAR, Evangelou stated. Additionally, millennials who moved to the state capital had the highest income of the areas.

“[Twenty-nine] percent is a great fare because we see in the 100 cities [examined] areas that are only at 5 percent,” Evangelou said.

When looking at statewide housing affordability, Madison is less affordable than competing cities, such as Milwaukee, which sits at 33 percent affordability for all millennials in the metro area, according to the NAR.

More demand, less availability

Madison rent price saw a higher annual increase just this year of $40, hitting $1,252. This is up 3.3 percent from the previous year, according to a report from Rent Café, a nationwide internet listing service that enables renters to easily find apartments and houses for rent.

Madison was one of the few emerging tech hubs where rents didn’t outpace IT wages in the last three years, according to a study the company released in March.

“Although millennials had their fair share in driving this demand [for housing], they were not the sole age group to put pressure on the available rental stock in Madison,” said Nicky Ludean, the marketing communications specialist with Rent Café.

While the slight hike in rent is unfavorable to those with tight wallets, it's not unexpected.

The influx of young professionals, tech hires and millennials looking to settle down places a greater demand on the market and the current number of units available.

Matt Wachter, manager of the Office of Real Estate Services in the City’s Economic Development Division, has been examining the issue with the Housing Strategy Committee for the past six years.

So many young people are moving to Wisconsin’s capital that the average age of the person in Madison has gone down — and there’s been a huge swell in demand for rental housing, he explained.

“That's why we see many years of solid construction of 1,000, 2,000 apartments per year just to keep up with all that influx of people coming here, mostly millennials,” Wachter said.

A shortage of rental housing is not new — the Housing Strategy Committee found this issue goes back almost 10 years.

“It’s not like we’re predicting some big change next year — we’ve been sort of in this state of a consistent shortage of housing in the city for a long time, and that’s not really changing,” Wachter added. “We were slowly digging ourselves out of the hole and that kind of flattened; the production of apartments has slowed down in the last year or so.”

This constant demand in the market is a good thing for economic stimulation, but it comes with challenges, namely that lower-income households can struggle to find housing.

For the general housing market, the city isn’t making big changes. However, it does take a more active role in affordable housing for those who need assistance with a variety of tools, like the affordable housing fund and housing authority measures.

Renting vs. Buying

Some people are trying to dodge the rising rent rates by turning to homeownership.

Schmitt lived in an outmoded apartment on the east side for three years following his time at UW, paying approximately $1,000 a month before realizing he wasn’t getting his money's worth.

“Post-college [housing] is a lot more difficult, especially when I was starting out without necessarily a high paying job,” Schmitt said. “Even then, in 2014, 2015, rent was still really expensive in Madison relative to the size of the city. In my head, I’m trying to figure out why the cost of rent in Madison is as expensive as Milwaukee or Chicago. That seems a little out of whack.”

That’s when he embarked on the precarious adventure of purchasing a home — precarious because homeownership rates for younger Americans have fallen sharply over the last decade.

There was a time in the U.S. when the wealth of U.S. households was built on the foundation of homeownership. That is no longer the case.

The median age of a home buyer is 46 — putting Schmitt well into the lower bracket — the oldest since the National Association of Realtors began keeping records in 1981, according to the Wall Street Journal.

"The main way that renting and ownership are connected is because the entry-level price of a starter home is so high and because rents are so high, that makes [it] a double whammy for an entry-level homeowner because you have to save a lot for a down payment," Kurt Paulsen, a UW-Madison associate professor of urban and regional planning, told Madison Magazine. "It's hard to save a lot when your rents are high.”

Schmitt refined some useful principles on his journey from renting to buying: patience, snap decision-making and a newfound interest in HGTV. But he also vanquished the external stress that comes with homeownership.

“There’s a lot of pressure for younger people to [jump] jobs, to try new things, to see the world,” Schmitt said. “And at the same time, there’s the societal pressure of settling down, starting a family, being financially independent and financially secure — and those are competing forces that I struggled with post-graduation. I finally just took a step back and realized that I’m really happy here.”